The Insurer's Guide To Modernizing Print and Mail Communications

November 11, 2024

Insurance Industry Overview

The insurance industry is not exactly known as a digital pioneer. Its reliance on traditional print and mail communication could easily be misinterpreted as an industry-wide aversion to innovation. The truth of the matter is that regulators heavily scrutinize insurers. In the name of transparency, insurance companies are legally obligated to deliver many critical documents to their insureds. From monthly bill statements and explanation of benefits (EOB) to cancellation notifications and renewals, this industry requires meticulous documentation to stay on the right side of regulators—and historically, that’s been on paper.

Over the past few decades, many sectors have joined the digital revolution, choosing electronic communications where possible. There are various reasons for the switch, including consumer demand, environmental considerations, and internal and external efficiencies. Insurers haven’t been so quick to adopt digital methods for a couple of key reasons:

- Insured Preferences: 26% of insureds prefer to receive paper insurance policy statements and services by physical mail.

- Compliance Requirements: Legal requirements require that documents like policy cancellations and renewals be delivered in physical form unless the insured gives explicit consent for electronic delivery.

These factors present unique challenges for insurers, who find themselves relying on outdated communication methods and technology that don’t meet modern expectations. Legacy print and mail solutions contribute to slower processing, higher costs, and a lack of personalization, ultimately leading to frustrated insureds.

None of this means insurance companies can’t adopt a more progressive approach to communicating with insureds. This guide explores innovative modernization strategies to enhance insured satisfaction, reduce operational inefficiencies, and ensure seamless multi-channel engagement. When insurers successfully implement these strategies, their print and mail communications are suddenly transformed from documents ticking a compliance box into powerful relationship–building tools.

Simplifying Insurance With Expert Document Design

Generally speaking, insurers don’t have many opportunities to connect with insureds, relying mainly on policy documents and statements to forge relationships. With so few touchpoints, it’s paramount that each one is executed as effectively as possible to fuel loyalty and connection. Ensuring documents are well-designed and easy to understand is crucial. Unclear policy statements can frustrate insureds, erode trust, and ultimately lead to a flood of support calls. Research reveals that 79% of consumers spend less than five minutes reviewing their bills, making it essential to convey critical information effectively.

Strategically designed documents require clear, intuitive layouts, which improve readability, speed up payments, and reduce support costs. When insureds can find information quickly, it has been shown to improve on-time payment rates and reduce routine inquiries to call centers, freeing staff to deal with more complex, high-value interactions.

The Art of Clear Design

1. Precision in Presentation:

- Prioritize critical data: Make policy details, premium amounts, and due dates impossible to miss.

- Use white space and typography to create a visual hierarchy that guides the eye.

- Deploy bullet points and concise headings to transform complex clauses into easily digestible information.

2. Strategic Use of Color:

- Leverage color psychology to highlight critical sections and prompt action.

- Studies show that 76% of consumers find color-coded documents significantly easier to navigate.

- A striking 43% of consumers are more likely to pay on time when presented with a visually appealing, color-enhanced bill.

3. Data Visualization Mastery:

- Transform abstract concepts into compelling visual stories using charts and infographics.

- Illustrate claims processes, benefit comparisons, or coverage options with intuitive graphics that speak louder than words.

Maximize the Utility of Transactional Documents

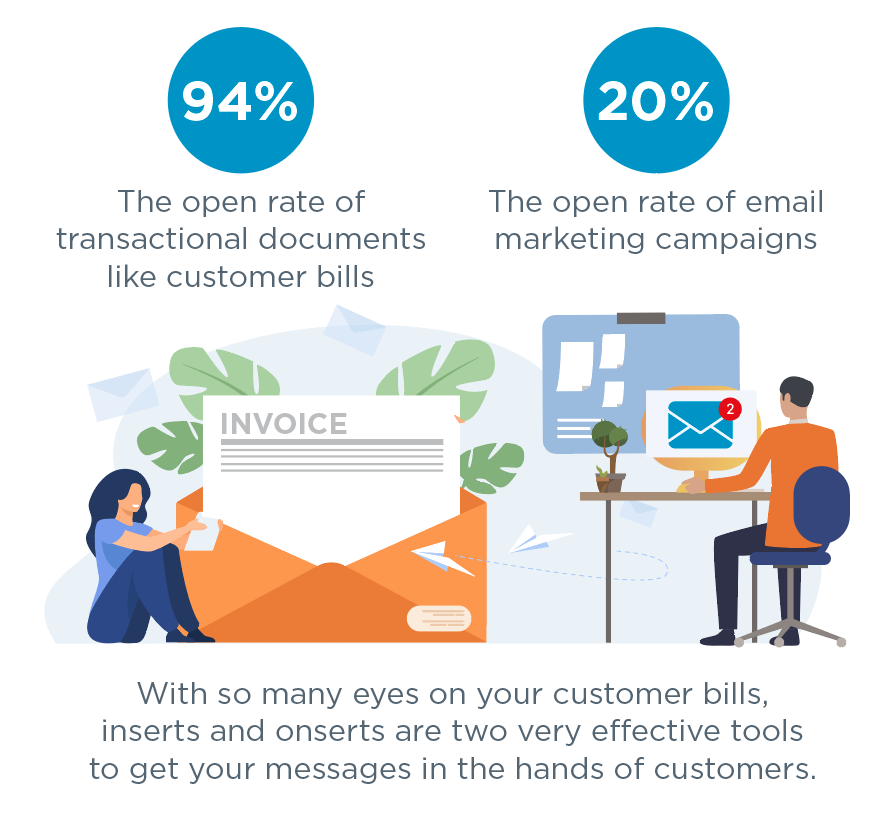

Policy statements, bills, renewal reminders, and EOB statements aren't just paperwork – they’re a gateway to exceptional engagement. With a 94% open rate, these documents outperform traditional email marketing campaigns by nearly 5 to 1. Using this captive audience offers a unique opportunity to communicate, educate, and build lasting relationships with insureds at no additional cost.

Two tools to maximize the hidden potential of transactional mail:

1. Inserts (Bill Stuffers): Additional materials placed in the envelope with transactional documents to communicate promotions, policy changes, or insurance tips. Given that 39.5% of consumers discard these, insurers should conduct a cost-benefit analysis of purchasing and inventory management.

2. Onserts: Information printed directly on the pages following the main documents. These are less likely to be discarded, work seamlessly with paper and e-bills, eliminate inventory concerns, and require no production lead times.

Strategically leveraging onserts and selectively using inserts transforms every transaction into an opportunity for insurers to enhance insured education, boost cross-sell and upsell opportunities, improve retention, and streamline operational costs.

Using the Power of Personalization to Enhance Policyholder Engagement

Since most insurance communication contains a policyholder’s name and account details, some insurers may think they’ve covered personalization. But this is really just scratching the surface. Insurers looking for true engagement need to take a deeper, more nuanced approach.

Insurance companies have a wealth of data on policyholders, which is the keystone to effective personalization. Using payment history, data from Customer Information Systems (CIS), surveys, web analytics, and interactions with agents opens a window into insureds' minds, exposing their preferences, behaviors, and needs.

Using Variable Data Printing (VDP) allows insureds to tailor every aspect of their printed communications. With VDP, each document becomes a unique, personalized touchpoint in the policyholder's journey.

Personalization Strategies That Drive Results

1. Tailor Messages to Behavior Patterns: Identify groups with similar behaviors and create targeted messages for these segments. For example, encourage late payers to enroll in auto-pay or provide high-claim users with detailed explanations of their benefits.

2. Incorporate Personalized Recommendations: Use data analytics to offer personalized tips and recommendations, such as suggesting coverage adjustments based on recent life changes or providing customized advice on reducing claims.

3. Highlight Relevant Information: Ensure that critical information such as billing amounts, due dates, and policy changes are prominently displayed and personalized for each policyholder.

4. Use Eye-Catching Design Elements: Enhance personalization with visually engaging elements such as color-coded sections and graphics tailored to the policyholder's data.

5. Leverage Multi-Channel Delivery: Offer personalized documents through multiple channels, including print, email, and mobile apps, to meet policyholders' preferences and ensure seamless communication.

Capitalize on USPS Promotions and Incentives To Modernize Insurance Communications

The United States Postal Service (USPS) Promotions and Incentives Program offers insurers an opportunity to transform their print and mail strategies while achieving significant cost savings. This program is particularly relevant for insurers looking to modernize their insured communications, enhance engagement, and optimize mailing costs.

Understanding the USPS Promotions and Incentives Program

The USPS designed this program to encourage businesses, including insurance companies, to adopt cutting-edge direct mail strategies. Benefits include:

- Cost Savings: Potential postage discounts of 3-4%, which can translate to substantial savings for high-volume mailers like insurance companies.

- Enhanced Insured Engagement: The program promotes the use of interactive elements that can significantly boost recipient engagement and response rates.

- Opportunity for Innovation: It provides a framework for insurers to experiment with new technologies and techniques in a cost-effective manner.

To get the most out of the program, collaboration with experienced print and mail vendors is highly recommended. These expert vendors can help design mailpieces that qualify for the program, ensure compliance with postal rules, track campaign performance, and help ensure an optimal return on investment.

Harness the Power of Advanced Web-Based Tools and Cutting-Edge Production Equipment

Being open to technological advancements is vital for insurance companies concerned with staying competitive and meeting the evolving needs of policyholders. Since the industry is so reliant on paper, it makes sense to first focus on modernizing its physical communications. Finding a partner offering a print and mail solution with advanced web-based tools and production equipment is an essential step in the modernization journey.

An effective print and mail solution will empower insurance professionals to control their document production process by providing:

- Real-time creation and modification of documents

- Personalization at scale

- Seamless integration with existing systems

- Robust tracking and reporting capabilities

Real-time monitoring and management of the entire production process allow insurers to:

- Identify and address bottlenecks quickly

- Ensure compliance with regulatory requirements

- Optimize resource allocation

- Respond swiftly to changing market conditions

On the production side, partnering with a vendor that offers diverse printing options is crucial. Key printing capabilities to look for include:

- Versatile format options (cut-sheet or roll-fed)

- Multiple color choices (monochrome, highlight, or full-color)

- Duplex printing capabilities

- High-speed, high-volume processing

A comprehensive solution should encompass the entire mail preparation process, including high-volume folding and insertion, selective insertion for personalized communications, inventory management, and postal optimization services. KUBRA offers an all-in-one suite of tools that covers the whole document lifecycle, from creation to printing, mailing, and archiving.

Embrace an Omni-Channel Strategy for a Superior Insured Experience

A one-size-fits-all approach rarely succeeds, especially when it comes to meeting the diverse needs of policyholders. They have grown accustomed to seamless interactions across multiple channels and they expect their insurers to provide a comparable experience.

A robust omni-channel solution should offer:

1. Diverse Communication Channels: Expanding traditional print and mail to digital options like email, SMS, and secure online portals.

2. Flexible Payment Options: Providing a wide array of payment methods, including online payments, mobile apps, automatic deductions, and traditional check payments.

3. Consistent Branding and Messaging: Ensuring that all communications maintain a unified look and feel that reinforces the brand identity.

4. Real-Time Updates and Access: Allowing insureds to view their policy information, make changes, and access support across all channels in real time.

5. Intelligent Channel Switching: Enabling insureds to start an interaction on one channel and seamlessly continue it on another without disruption or loss of continuity.

The benefits of an omni-channel approach for insurers include enhanced insured satisfaction, improved data analytics, increased operational efficiency, higher revenue and retention, and competitive advantage.

Insurer’s Checklist For Selecting the Right Print and Mail Vendor

Insurance companies looking for a reliable print and mail vendor should focus on several crucial criteria to ensure successful policyholder communications. A qualified vendor must demonstrate strong regulatory compliance, including adherence to data protection laws like GDPR and HIPAA while maintaining essential certifications such as SOC 1 Type II and SOC 2 Type II. Data security is paramount, with vendors needing robust encryption standards and secure email delivery protocols.

The ideal partner should also offer advanced postal optimization services, including CASS certification and Intelligent Mail barcode capabilities while maintaining high-quality control standards through on-site USPS representatives. Additionally, vendors should provide comprehensive disaster recovery plans, use modern production equipment, and demonstrate a commitment to environmental sustainability.

Service Level Agreements (SLAs) should clearly outline performance expectations, including turnaround times and quality metrics while ensuring seamless integration with existing insurance platforms.

The graphic below provides a complete checklist that outlines essential criteria for ensuring regulatory compliance, operational efficiency, and superior policyholder satisfaction.

Download Checklist

Modernizing Insurance Communications for Lasting Impact

There’s no denying that electronic communications are ubiquitous across all industries, but this has not triggered the predicted demise of print. KUBRA research indicates that it’s very much alive and continues to play an important role in insurance communications. Insurers should prioritize updating their print and mail strategies to meet the expectations of policyholders who still value physical documents, ensuring they deliver a modern experience.

By implementing the strategies outlined in this guide—such as creating well-designed documents, leveraging personalization, utilizing USPS incentives, harnessing advanced web-based tools, and embracing an omni-channel approach—insurers can transform their print communications from a mere necessity into a powerful asset. These modernization efforts not only cater to insured preferences but also drive operational efficiencies and create new opportunities for engagement and growth.